Introduction

Here at WiseAlpha we are leading the digital revolution in the multi-trillion corporate bond market with a mission to create fair access for all. We are delighted to partner with you.

The WiseAlpha API provides access to the WiseAlpha Fractional Bond Market where customers can trade corporate bonds.

We provide two types of API access, Super accounts and Individual accounts. Super accounts (typically Fintechs, Banks and Online investment platforms) can onboard customers and route orders directly to the WiseAlpha market from their Customers on a real time execution basis. Individual accounts can access information and execute trades on behalf of their own account.

When a Customer is on-boarded by a Super account, a series of steps must be taken including KYC/AML so that WiseAlpha can comply with its regulatory requirements. If you think that these steps can be simplified because of your own regulatory permissions and putting in place a suitable KYC/AML reliance agreement with us then please contact us.

The WiseAlpha API is REST-based and returns responses in JSON.

Our API is currently in beta, but please contact us if you're interested in learning more and getting early access to an API key. Until V1 is released we will be adding functionality with potentially breaking changes. All changes will be documented in the versioning section.

We have usage examples in cURL and Python. You can view code examples in the area to the right, and you can switch between shell (i.e., using bash, cURL and jq) and Python.

The root URL for all requests to the WiseAlpha production system is

https://api.wisealpha.com/v1/. The production system will not be available until V1 is fully

released, but a sandbox version is available at https://api-sandbox.wisealpha.com/v1/.

General

We publish a Corporate Bond Investment Glossary which is useful if you're unfamiliar with some of the terms used in this documentation.

Authentication

Token based authentication

To authorize, use this code:

import requests

headers = {'Authorization': 'Token $API_KEY'}

api = requests.get('$API_ROOT_URL/api_endpoint_here', headers=headers)

# With shell, you can just pass the correct header with each request

curl "$API_ROOT_URL/api_endpoint_here"

-H "Authorization: Token $API_KEY"

Make sure to replace

$API_KEYwith your API key.

WiseAlpha uses API keys to allow access to the API. Access is limited to accounts that have been created by the account accessing the API. If you want to make API calls on behalf of another user see OAuth.

WiseAlpha expects for the API key to be included in all API requests to the server in a header that looks like the following:

Authorization: Token $API_KEY

In the code examples, we use the string $API_KEY as a substitute for your API key.

OAuth 2.0

WiseAlpha also supports an OAuth 2.0 flow in order to make calls on behalf of a user. In order to do this you will need to set-up an application in the developer portal. Refer to the OAuth section for more information.

Expansion

Some endpoints will detail an Available Expansions section. This will detail what items maybe be optionally returned by the endpoint. To use an expansion include expand=expansion_name in the query string you send to the endpoint. Some endpoints may include multi-level expansions. Nest expansions are of the form expand=parent__child

Field Exclusion

Some endpoints allow field exclusion, this is done through providing the query string exclude=field_name. Nested exclusions are also supported and can be used like exclude=field__child_field

Field Inclusion

Some endpoints allow field inclusion, this is done through providing the query string only=field_name. Nested inclusions are also supported and can be used like only=field__child_field. All non-included fields will be excluded.

Pagination

api = requests.get('$API_ROOT_URL/customers/',

params={'offset': 5, 'limit': 5},

headers=headers)

curl -s "$API_ROOT_URL/customers/?offset=5&limit=5" \

-H 'Authorization: Token $API_KEY' | jq .

Returns the following JSON pagination object:

{

"count":20,

"next":"$API_ROOT_URL/customers/?limit=5&offset=10",

"previous":"$API_ROOT_URL/customers/?limit=5",

"results":[

{

"customer_id":"10000001",

"email":"user5@wisealpha.com",

...

}

...

]

}

For most lists of objects, you can limit the number of results returned

via parameters to the GET request.

- To limit the number of results returned, set the parameter

limit - To set the first result to return, set the parameter

offset

So a request to $API_ROOT_URL/customers/?offset=5&limit=5 will return the second page of five

senior secured bonds.

Any request to a list resource returns a pagination object with the following fields:

| Name | Description | Type |

|---|---|---|

| count | Total number of results available | Integer |

| next | Resource URL for the subsequent page of results | String |

| previous | Resource URL for the previous page of results | String |

| results | Results array | Array |

If no limit is supplied, then the limit defaults to 100.

Ordering

api = requests.get('$API_ROOT_URL/customers/',

params={'ordering': '-date_joined',},

headers=headers)

curl -s "$API_ROOT_URL/customers/?ordering=-date_joined" \

-H 'Authorization: Token $API_KEY' | jq .

Will order the customer list in descending order of the

date_joinedfield

List endpoints will provide details on the fields that the returned data can be ordered on. Prefix a field with - to order by the field descending, e.g. -created will return the data by the created field in descending order.

Filtering

api = requests.get('$API_ROOT_URL/customers/',

params={'last_name__istartswith': 'bar', 'first_name__icontains': 'foo'},

headers=headers)

curl -s "$API_ROOT_URL/customers/?last_name__istartswith=bar&first_name__icontains=foo" \

-H 'Authorization: Token $API_KEY' | jq .

Will filter the customer by customers who's last name starts with bar and who's first name contains foo (both case insensitive)

List endpoints will detail all the fields that support filtering and the lookups supported. A description of the lookups is given below. The filter string is formed by joining the field name and the lookup name with a __. E.g. filtering the last_name field to find last names beginning with bar (case insensitive) would be done by providing the query string argument last_name__istartswith=bar.

Text field lookups

| Name | Description |

|---|---|

| exact | Filter by exact matches |

| iexact | Filter by exact matches (case insensitive) |

| contains | Filter when the field contains the value |

| icontains | Filter when the field contains the value (case insensitive) |

| startswith | Filter when the field starts with the value |

| istartswith | Filter when the field starts with the value (case insensitive) |

| endswith | Filter when the field ends with the value |

| iendswith | Filter when the field ends with the value (case insensitive) |

Datetime field lookups

| Name | Description |

|---|---|

| gt | Filter by records where the datetime is greater than |

| gte | Filter by records where the datetime is greater than or equal |

| lt | Filter by records where the datetime is less than |

| lte | Filter by records where the datetime is less than or equal |

| exact | Filter when the datetime matches |

Data types

Throughout the API, in requests and responses, the WiseAlpha API uses the following basic data types.

| Data Type | Description |

|---|---|

| Integer | An integer number, represented by the native JSON number type. |

| Decimal | A decimal number represented as a JSON string, e.g. "100.55". All money amounts are represented in this way. |

| Float | A decimal number represented as a JSON number, e.g. 1.123456789. This type is used when precision is important. |

| Boolean | A value of true/false represented by the native JSON Boolean type. |

| String | A text string |

| DateTime | An ISO 8601 DateTime string, e.g. "2015-01-01T00:00:00+00:00" |

| Date | An ISO 8601 calendar date, e.g., "2015-01-01" |

| Array | A collection of items |

| Currency | A string containing an ISO 4217 currency code |

| Customer ID | User accounts are identified using 8-digit integers, zero padded and encoded in a String. E.g., 10000001. |

In requests, you can use the special value me to target the user account associated with the API key. |

|

| Reference ID | Other objects are identified by a reference string, consisting of a type tag, and a zero-padded ID number. E.g., EVENT00000099 |

| Country Code | An ISO 3166-1 alpha-2 country code e.g. 'gb' |

| Limited Html String | For some product descriptions we return a limited set of HTML. The HTML returned will be valid XHTML and be limited to the tags ['a', 'ul', 'li', 'p', 'div'] and the attributes ['href', 'alt']. |

| Markdown String | Markdown string |

Pricing

The products on WiseAlpha are bought and sold at a price that's a percentage of par. So a price of 100 indicates that a £1 investment will buy £1 of the product. A price of 90 indicates that a £1 investment will buy £1.11 of the product. A price of 110 indicates that a £1 investment will buy £0.90 of the product.

Rate limiting

Currently the only active rate limiting is triggered by failed authentication requests. All other endpoints do not have a rate limit. WiseAlpha reserves the right to impose a rate limit on requests at a later date.

Testing

We provide a sandbox server that you can use to test out creating users, purchasing investments

and responding to events. Updates to this server do not have real world effects,

(and WiseAlpha may occasionally clear out any data contained in this server when re-syncing

with the production system). To access the sandbox server, use the URL root

https://api-sandbox.wisealpha.com/v1/.

Versioning

Non-breaking API changes may be made at any time by the WiseAlpha team. An example of a non-breaking change would be the addition of a field returned by an endpoint, addition of a new endpoint or additional of an optional parameter to an existing endpoint. Non-breaking changes will appear in the API Version log as a minor version number increase and will be documented and dated.

Breaking API changes will be rolled out under a major version number, will have a new endpoint and will run in parallel with previous versions. In the event of the WiseAlpha team deprecating a previous API release there will be plenty of notice and help to move onto the new endpoints.

API Version 1.0

Release 2020-01-15

- Remove product_ticker from products

Release 2019-10-03:

- Introduce buy_orders and sell_orders entrypoint

- Rename fields in the market request and response for consistency with order objects:

- buys[].buy_type -> buys[].type

- buys[].amount_currency -> buys[].currency

- buys[].amount_of_principal -> buys[].principal

- buys[].amount_of_interest -> buys[].interest

- buys[].amount_total -> buys[].total

- sells[].amount_currency -> sells[].currency

- sells[].amount_of_principal -> sells[].principal

- sells[].amount_of_interest -> sells[].interest

- sells[].amount_of_interest_fees_due -> sells[].service_fee

- sells[].amount_of_sale_fee -> sells[].sale_fee

- sells[].amount_total -> sells[].total

- Make market returned balance the same as balance returned by balances entrypoint.

- market/quote entrypoint: Add a

warningsfield to contain a list of reasons why the resulting market request might fail. - Orders: Introduce original_id to correlate current order with original order.

- order events: Fields in the event were changed after implementation.

- We no longer create a order.filled event when an order enters the

CONFIRMstate.

- We no longer create a order.filled event when an order enters the

Still in beta.

Responses

On success we return a suitable HTTP success code

| Success Code | Meaning |

|---|---|

| 200 | OK -- The request was successfully processed and/or the requested data returned. |

| 201 | Created -- We created the object as you requested. |

| 202 | Accepted -- The request has been accepted for processing, but the processing has not been completed. The request may still fail during offline processing. You will be notified of success/failure via a webhook.. |

We spell out the response code for each request in the examples below. If no response code is given, 200 - OK will be returned.

Errors

{

"email": ["Customer with this Email already exists."]

}

On error, we return a suitable HTTP error code. For many errors, we also return the nature of the error as a JSON fragment as illustrated.

| Error Code | Meaning |

|---|---|

| 400 | Bad Request -- The request could not be processed due a client error |

| 401 | Unauthorized -- Your API key could not be validated. |

| 403 | Forbidden -- You tried to execute a request that you do not have rights to, i.e. make a trade on an account you do not have permission to trade on. |

| 404 | Not Found -- The specified resource could not be found. |

| 405 | Method Not Allowed -- You tried to access an endpoint with a method that it does not accept |

| 406 | Not Acceptable -- You requested a format that isn't JSON. |

| 422 | Unprocessable Entity - The request was understood but could not be processed. E.g. there where not sufficient funds available to complete a market order. |

| 500 | Internal Server Error -- There was an unexpected server side problem. |

| 503 | Service Unavailable -- We're temporarily offline for maintenance. Please try again later. |

OAuth

In order to create and configure an OAuth application you will need a WiseAlpha account configured with access to the developer portal, contact our partners team if you're interested.

The root URL for all OAuth requests to the WiseAlpha production system is

https://www.wisealpha.com/o/. The production system will not be available until V1 is fully

released, but a sandbox version is available at https://sandbox.wisealpha.com/o/. This URL might change before the production system is launched.

Creating an app

Once you can access the developer portal you will be able to create a new application. When creating the application you will need to provide:

- An application name

- The allowed set of redirect URLs

You will be provided with a client_id and client_secret which can be modified at creation time. Apps created on the sandbox environment cannot be moved to the production environment so you'll need to create a production app when you're ready to go live.

When creating or editing your application you will see the below fields.

| Name | Description |

|---|---|

| Name | The application name - users will see this when authorizing your application. |

| client_id | This publically identifies your application. |

| client_secret | This is your application's secret. |

| client_type | Either public or confidential depending on if the credentials retrieved can be stored in a secure way. |

| authorization_grant_type | Either authorization_code or implicit. Only authorization_code should be used for production applications - see the aside below |

| redirect_uris | The set of URIs that the server will return the browser to after the user grants or denies the application's request for access. |

Scopes

In order to request a specific set of scopes when redirecting to the authorization URL, include the scope parameter with a space separated list of the below scopes. If this is not included, all scopes will be requested.

| Name | Description |

|---|---|

| read_investments | Grants read access to the user's investment portfolio |

| read_profile | Grants read access to the user's profile |

| write_profile | Grants write access to the user's profile |

| trade | Grants access to trade |

| fund | Grants access to issue deposit and withdrawal requests |

| create_account | Grants access to create new investment accounts |

OAuth 2.0 Authorization code flow

WiseAlpha supports a standard OAuth 2.0 Authorization code grant flow, at it's heart it's very simple:

- You will have a link on your application to connect to people's WiseAlpha accounts

- This link will send a request to WiseAlpha's

authorizeendpoint - The user sees the authorization prompt and approves the app’s request

- The user is redirected back to the application with an authorization code in the query string

- The application exchanges the authorization code for an access token

- The access token allows you to make API calls on behalf of the user limited by the scopes that your application asked the user to approve.

/authorize/

api = requests.get('$OAUTH_ROOT_URL/authorize/?response_type=code&client_id=ZOknOs0kO02ZyUA8Z6eBUL3cJNip2pRUE0Oi6P71&redirect_uri=https%3A%2F%2Fwww.example.com%2Fauthorize&state=zxx5LbYXdbkbRhfUXCHz2SISHkUgMR&scope=read')

curl -s "$OAUTH_ROOT_URL/authorize/?response_type=code&client_id=ZOknOs0kO02ZyUA8Z6eBUL3cJNip2pRUE0Oi6P71&redirect_uri=https%3A%2F%2Fwww.example.com%2Fauthorize&state=zxx5LbYXdbkbRhfUXCHz2SISHkUgMR&scope=read" \

| jq .

Will return the user to the redirect URL indicating if they have or have not accepted the request for access

- GET: The user's browser should be redirect to this URL in order to give them the opportunity to grant access to your application

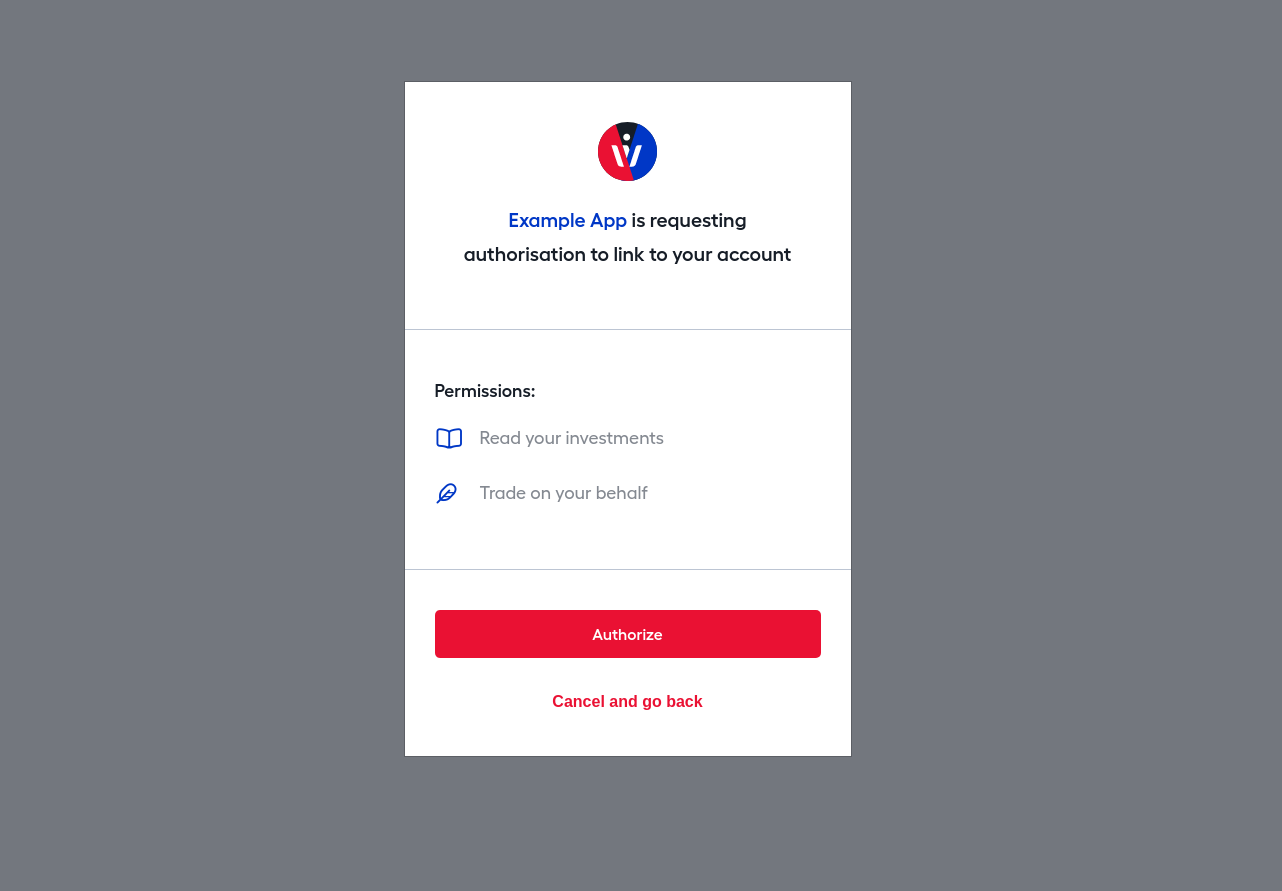

The user will see a screen like this:

Once the user has granted or denied access to your application their browser will be redirected back to the provided redirect URI.

/token/

The token endpoint can be used to swap an authorization code for an access/refresh token as well as to using a refresh token to get a new access token.

Exchange Authorization Code

Available Methods:

- POST: Exchange an authorization code for an access token.

| Name | Description | Data Type |

|---|---|---|

| grant_type | authorization_code |

String |

| code | An authorization code returned by the authorize endpoint. | String |

| client_id | Your application's client_id. |

String |

| client_secret | Your application's client_secrent. |

String |

Response:

| Name | Description | Data Type |

|---|---|---|

| access_token | An access token. | String |

| token_type | Bearer |

String |

| expires_in | The seconds until token expiry. | Integer |

| refresh_token | A refresh token. | String |

| scope | The scopes the access token gives access to. | String |

Refresh Token

Available Methods:

- POST: Exchange an authorization code for an access token.

| Name | Description | Data Type |

|---|---|---|

| grant_type | refresh_token |

String |

| refresh_token | A refresh token. | String |

| client_id | Your application's client_id. |

String |

| client_secret | Your application's client_secrent. |

String |

Response:

| Name | Description | Data Type |

|---|---|---|

| access_token | An access token. | String |

| token_type | Bearer |

String |

| expires_in | The seconds until token expiry. | Integer |

| refresh_token | A refresh token. | String |

| scope | The scopes the access token gives access to. | String |

Products

Displaying WiseAlpha market products

The product endpoints contain all the information needed to create a marketplace for WiseAlpha products. WiseAlpha products fit into a number of marketplaces:

- The Main market - this is the main WiseAlpha market, investing requires the

can_investpermission - The High Yield market - this market contains higher yielding and therefore higher risk products and requires users to have the

can_invest_high_yieldpermission. - The Perpetuals market - this market contains AT1 and Perpetuals which requires users to have the

can_invest_perpetualspermission. - The Special Situation market - this market contains distressed products which requires users to have the

can_invest_special_situationspermission.

Product Data Types

We use the following data types in the product endpoints:

Product object

| Name | Description | Data Type |

|---|---|---|

| product_id | Product id | String |

| state | The state of the product, valid states are open, closed, suspended, repaid, defaulted or exchanged |

String-Enum |

| market_type | The WiseAlpha marketplace that the product appears in main_market, high_yield, perpetuals, special_situations |

String-Enum |

| investment_type | bond |

String-Enum |

| seniority | One of not_specified, super_senior_secured, senior_secured, second_lien_secured, unsecured, unsecured_pik or unsecured_at1 |

String-Enum |

| categories | List of categories this product falls into. | Array of Product Category objects |

| isin_code | International Securities Identification Number | String |

| currency | Currency | String |

| buy_price | The current market buy price | Decimal |

| sell_price | The current market sell price | Decimal |

| maturity | The maturity of the bond | Date |

| sell_liquidity | The amount of current liquidity in the WiseAlpha marketplace for this product | Decimal |

| pending_liquidity | The amount of liquidity that will soon be injected in the WiseAlpha marketplace for this product | Array of Pending Liquidity objects |

| interest_period | The interest period | String |

| next_interest_payment | The next interest payment date | Date |

| borrower | The legal entity that issued the bond | String |

| amount_outstanding | The total amount of the bond in issue | Decimal |

| coupon | The annual interest rate paid | Decimal |

| coupon_string | A description of the coupon. (e.g. 4.875, L+12.0, E+5.25) | String |

| coupon_type | A human readable detailed description of the coupon type. (Fixed Rate, Floating Rate, PIK, PIK Toggle) | String |

| call_schedule | The products call schedule, e.g.: [{"date": "2019-09-15", "price": "102.75"}, {"date": "2020-09-15", "price": "101.375"}, {"date": "2021-09-15", "price": "100.00"}] |

Array of Call Option objects |

| yield_to_maturity | The current yield if bought at the market price and held to maturity. | Decimal |

| current_yield | The current yield, ignoring buy price. | Decimal |

| rating_moodys | The Moody's rating | String or null, e.g. B3 |

| rating_fitch | The Fitch rating | String or null, e.g. BBB |

| rating_sandp | The S&P rating | String or null, e.g. B+ |

| accrued_interest_rate | The amount of interest accrued per unit invested, e.g. 1p interest accrued for every £1 invested | Float |

| company | Company details | Company object |

| cashflows | Cashflow details, optionally returned with the cashflows expansion |

Cashflow object |

| zero_interest_fees | Is this product a zero fee product? | Boolean |

| product_url | The URL for this product on the WiseAlpha website | String |

| total_invested | Returns the total invested in this product. | Decimal |

| user_invested | Not included unless specified in an expand, this will return the aggregate amount the calling user holds in the product across all their investment accounts. | Decimal |

| num_important_updates | Number of important updates for product | Integer |

| access_restrictions | List of access restrictions that apply to this product | Access restrictions object |

| first_added_to_market | The date this product was first added to the WiseAlpha market | Date |

| last_added_to_market | The date this product was last added to the WiseAlpha market | Date |

Company object

| Name | Description | Data Type |

|---|---|---|

| company_id | Company id | String |

| company_name | The name of the company | String |

| industry | The industry that the company operates in | Industry object |

| stock_symbol | A unique reference to a companies stock. Available for publicly listed companies only | String |

| description | A description of the company's undertakings | Limited Html String |

| borrower_status | One of performing or non-performing |

String-Enum |

| website | The company's website | String |

| formation_date | The company's formation date | String |

| country_of_origin | The country of origin of the company | String |

| ownership_status | A description of the current ownership status - e.g. private held, publicly traded, etc | String |

| senior_debt | The percentage of the companies capital structure as senior debt | String |

| junior_debt | The percentage of the companies capital structure as junior debt | String |

| equity | The percentage of the companies capital structure as equity | String |

| tile_description | A short description of the company | String |

| tile_image | An image that can be used in a product list | String |

| logo | A logo that can be used in a product list | String |

| capital_structure | A breakdown of the company's capital structure, optionally returned with the company__captital_structure expansion |

Array of Capital Structure objects |

| key_financials | Key financial information, optionally returned with the company__key_financials expansion |

Key Financials object |

| important_updates | Important updates on the company, optionally returned with the company__important_updates expansion |

Array of Note objects |

Industry object

| Name | Description | Data Type |

|---|---|---|

| key | Identifier for the industry | String |

| name | The name of the industry | String |

Capital Structure object

| Name | Description | Data Type |

|---|---|---|

| capital_type | String | |

| amount | Decimal | |

| currency | String | |

| ebitda | Decimal | |

| ebitda_interest | Decimal | |

| capitalisation | Decimal | |

| maturity | Date | |

| margin | String | |

| footnote | String | |

| is_important | Boolean | |

| is_total | Boolean |

Key Financials object

| Name | Description | Data Type |

|---|---|---|

| data | Table of key financial information for different years in markdown format | String |

| source | The source of the financial information | String |

Note object

| Name | Description | Data Type |

|---|---|---|

| datestamp | DateTime | |

| note_html | String |

Cashflow object

| Name | Description | Data Type |

|---|---|---|

| date | The date the cashflow occurs on. | Date |

| coupon_rate | The coupon rate of the cashflow. | Decimal |

| coupon_amount | The amount to multiple held principal by to get the predicted coupon payment for a fractional bond. | Decimal |

| principal_amount | The amount to multiple held principal by to get the predicted principal payment for a fractional bond. | Decimal |

| total_amount | The amount to multiple held principal by to get the predicted total cashflow payment for a fractional bond. | Decimal |

Call Option object

| Name | Description | Data Type |

|---|---|---|

| date | The date the call option begins. If set to 'any', the product can be called at any time | Date or String |

| price | The price at which the borrower can call at. | Decimal |

Pending Liquidity object

| Name | Description | Data Type |

|---|---|---|

| package_id | The ID of this package | String |

| package_type | One of: new-issue, primary-market |

String |

| settlement_date | The date on which the liquidity will be injected into the marketplace | Date |

| pending_amount | The amount of principal that will be injected into the marketplace | Decimal |

| accrued_interest_rate | The amount of accrued interest to pay per unit of principal in this package | Decimal |

Product Category object

| Name | Description | Data Type |

|---|---|---|

| category_id | A unique ID for the category | String |

| label | Text to display for the category | String |

Product Access Restrictions

This is a list of strings each of which represents a particular permission required to access this investment.

| Access Restriction | Meaning |

|---|---|

high_yield |

You need to have answered the High Yield questionnaire to access this investment. |

perpetuals |

You need to be of a suitable investor type and have answered the Perpetuals questionnaire to access this investment. |

special_situations |

You need to be of a suitable investor type and have answered the Special Situations questionnaire to access this investment. |

Access to each of the above markets can be achieved by going through the appropriate

authorisation process, setting investor type and answering questionnaires.

Each user's current restrictions are detailed in the access_restrictions record in

the Profile object.

Pricing Summary Data

Pricing summary data is generated with respect to a given pricing date. A pricing_date=YYYY-MM-DD can be passed in via a query string.

Some products have no available pricing, in which case a single field error will be returned with the message Pricing not enabled for this product.

| Name | Description | Data Type |

|---|---|---|

| initial_pricing_date | The date where the pricing information starts | Date |

| pricing_date | The pricing date the information is generated relative to | Date |

| at_pricing_date | The price at the pricing date | Decimal |

| one_day_prior | The price one day prior to the pricing date | Decimal |

| seven_days_prior | The price seven days prior to the pricing date | Decimal |

| twentyeight_days_prior | The price twenty eight days prior to the pricing date | Decimal |

| ninety_days_prior | The price ninety days prior to the pricing date | Decimal |

| year_start | The price at the year start | Decimal |

/products/

import requests

headers = {'Authorization': 'Token $API_KEY'}

api = requests.get('$API_ROOT_URL/products/?expand=cashflows', headers=headers)

curl "$API_ROOT_URL/products/?expand=cashflows,access_restrictions&for_user=me"

-H "Authorization: Token $API_KEY" | jq .

The above command returns pagination object containing a list of product objects:

{

"count": 1,

"next": null,

"previous": null,

"results": [

{

"product_id": "INVMKT00000001",

"state": "open",

"market_type": "main_market",

"investment_type": "bond",

"seniority": "super_senior_secured",

"categories": ["investment-grade"],

"access_restrictions": [],

"isin_code": "XS1577956516",

"currency": "GBP",

"buy_price": "101.5000",

"sell_price": "101.5000",

"maturity": "2022-08-01",

"sell_liquidity": "0.00",

"pending_liquidity": [

{

"settlement_date": "2018-01-01",

"pending_amount": "100000.00"

}

],

"interest_period": "6m",

"next_interest_payment": "2018-02-01",

"borrower": "NMG Finco plc",

"amount_outstanding": "370000000.00",

"coupon": "5.0000",

"call_schedule": [

{

"date": "2019-09-01",

"price": "102.50"

},

{

"date": "2020-09-01",

"price": "101.25"

},

{

"date": "2021-09-01",

"price": "100.00"

}

],

"yield_to_maturity": "4.7",

"current_yield": "4.9",

"rating_moodys": "B+",

"rating_fitch": "A-",

"rating_sandp": null,

"num_important_updates": 2,

"company": {

"company_id": "CO00000001",

"company_name": "McLaren",

"stock_symbol": "",

"description": "McLaren Technology Group is globally renowned as one of the world’s most illustrious high-technology brands. Since its foundation in 1963, McLaren has been pioneering and innovating in the competitive world of Formula 1, forging a formidable reputation which has seen the racing team win 20 World Championships and over 180 races.\r\n\r\nThe Group has built on its successful racing expertise and diversified to include a global, high-performance sports car business, McLaren Automotive, and a game-changing technology and innovation business, McLaren Applied Technologies.",

"website": "http://www.mclaren.com/",

"formation_date": "1963",

"country_of_origin": "UK",

"ownership_status": "Private",

"image": "https://d1x9604lsph6r7.cloudfront.net/media/cache/cd/24/cd243f12c0c6f5e7c999b46559d63af4.png",

"senior_debt": 19,

"junior_debt": 0,

"equity": 81,

"tile_description": "McLaren Technology Group is globally renowned as one of the world’s most illustrious high-technology brands.",

"tile_image": "https://d1x9604lsph6r7.cloudfront.net/media/cache/cd/24/cd243f12c0c6f5e7c999b46559d63af4.png",

"logo": "https://d1x9604lsph6r7.cloudfront.net/media/cache/25/71/25716d08c1c625febfae715e952258a8.png",

"industry": {

"key": "automotive",

"name": "Automotive"

}

},

"cashflows": {

{

"date": "2018-02-01",

"coupon_rate": "0.0500",

"coupon_amount": "0.0265",

"principal_amount": "0.0000",

"total_amount": "0.0265"

},

...

{

"date": "2022-08-01",

"coupon_rate": "0.0500",

"coupon_amount": "0.0250",

"principal_amount": "1.0000",

"total_amount": "1.0250"

}

}

}

]

}

This endpoint retrieves a list of the products available through the WiseAlpha market place. This endpoint supports inclusions and exclusions.

Available Methods

- GET: Returns all investment products currently available on WiseAlpha

Optional Query Strings for GET

| Name | Description | Data Type |

|---|---|---|

| market_type | Filter to return only products of a certain type. Valid values are main_market, high_yield, perpetuals and special_situations |

String-Enum |

| isin | Search the endpoint based on the ISIN code. Matches will be returned based on the the product ISIN code starting with the provided filter value. | String |

| category | Filter to return products that fall into the given category. E.g., 'investment-grade'. | String |

Available Expansions

| Name | Description |

|---|---|

cashflows |

Return the cashflows for the product. |

company__important_updates |

Return important updates for the product's company. |

company__capital_structure |

Return the company capital structure. |

company__key_financials |

Return key financial information for the product's company. |

access_restrictions |

Return any market access restrictions that apply to this investment. |

The access_restrictions expansion supports an extra optional request parameter: for_user=<user ID> | 'me'.

If for_user is set then the access restrictions returned apply to the given user. If the user has the

necessary permission, that access restriction will not be included in the returned list.

/products/{product_id}/

import requests

headers = {'Authorization': 'Token $API_KEY'}

api = requests.get('$API_ROOT_URL/products/1/', headers=headers)

curl "$API_ROOT_URL/products/1/"

-H "Authorization: Token $API_KEY" | jq .

The above command returns JSON structured like this:

{

"product_id": "INVMKT00000001",

"state": "open",

"market_type": "main_market",

"investment_type": "bond",

"seniority": "super_senior_secured",

"isin_code": "XS1577956516",

"currency": "GBP",

"buy_price": "101.5000",

"sell_price": "101.5000",

"maturity": "2022-08-01",

"sell_liquidity": "0.00",

"pending_liquidity": [

{

"settlement_date": "2018-01-01",

"pending_amount": "100000.00"

}

],

"interest_period": "6m",

"next_interest_payment": "2018-02-01",

"borrower": "NMG Finco plc",

"amount_outstanding": "370000000.00",

"coupon": "5.0000",

"call_schedule": [

{

"date": "2019-09-01",

"price": "102.50"

},

{

"date": "2020-09-01",

"price": "101.25"

},

{

"date": "2021-09-01",

"price": "100.00"

}

],

"yield_to_maturity": "4.7",

"current_yield": "4.9",

"rating_moodys": "B+",

"rating_fitch": "A-",

"rating_sandp": null,

"num_important_updates": 2,

"company": {

"company_id": "CO00000001",

"company_name": "McLaren",

"stock_symbol": "",

"description": "McLaren Technology Group is globally renowned as one of the world’s most illustrious high-technology brands. Since its foundation in 1963, McLaren has been pioneering and innovating in the competitive world of Formula 1, forging a formidable reputation which has seen the racing team win 20 World Championships and over 180 races.\r\n\r\nThe Group has built on its successful racing expertise and diversified to include a global, high-performance sports car business, McLaren Automotive, and a game-changing technology and innovation business, McLaren Applied Technologies.",

"website": "http://www.mclaren.com/",

"formation_date": "1963",

"country_of_origin": "UK",

"ownership_status": "Private",

"image": "https://d1x9604lsph6r7.cloudfront.net/media/cache/cd/24/cd243f12c0c6f5e7c999b46559d63af4.png",

"senior_debt": 19,

"junior_debt": 0,

"equity": 81,

"tile_description": "McLaren Technology Group is globally renowned as one of the world’s most illustrious high-technology brands.",

"tile_image": "https://d1x9604lsph6r7.cloudfront.net/media/cache/cd/24/cd243f12c0c6f5e7c999b46559d63af4.png",

"logo": "https://d1x9604lsph6r7.cloudfront.net/media/cache/25/71/25716d08c1c625febfae715e952258a8.png",

"industry": {

"key": "automotive",

"name": "Automotive"

}

}

}

This endpoint retrieves detailed information about a market product in WiseAlpha. While the list endpoint will only return products currently investible in the WiseAlpha marketplace, the detail endpoint will return products that have since closed (e.g. a bond which has been repaid).

Available Methods

- GET: Returns a product object

Available Expansions

| Name | Description |

|---|---|

cashflows |

Return the cashflows for the product. |

company__important_updates |

Return important updates for the product's company. |

company__capital_structure |

Return the company capital structure. |

company__key_financials |

Return key financial information for the product's company. |

access_restrictions |

Return any market access restrictions that apply to this investment. |

pricing_summary |

See Pricing Summary Data. |

The access_restrictions expansion supports an extra optional request parameter: for_user=<user ID> | 'me'.

If for_user is set then the access restrictions returned apply to the given user. If the user has the

necessary permission, that access restriction will not be included in the returned list.

/products/{product_id}/pricing.{format}

import requests

headers = {'Authorization': 'Token $API_KEY'}

api = requests.get('$API_ROOT_URL/products/1/pricing.csv', headers=headers)

curl "$API_ROOT_URL/products/1/pricing.json"

-H "Authorization: Token $API_KEY" | jq .

Available Methods

- GET: Returns the pricing data for the product available either as CSV or JSON depending on the format passed

Data is returned as either JSON:

[

{

"date": "2019-08-06",

"price": "102.5000"

},

{

"date": "2019-08-07",

"price": "102.7000"

},

{

"date": "2019-08-07",

"price": "102.5000"

}

]

Or CSV

2019-08-06,102.5000

2019-08-07,102.7000

2019-08-08,102.5000

/products/describe_types/

import requests

headers = {'Authorization': 'Token $API_KEY'}

api = requests.get('$API_ROOT_URL/products/describe_types/', headers=headers)

curl "$API_ROOT_URL/products/describe_types/"

-H "Authorization: Token $API_KEY" | jq .

The above command returns a pagination object containing a list of investment type objects:

{

"count": 6,

"next": null,

"previous": null,

"results": [

{

"market_type": "main_market",

"name": "Senior Secured",

"category": "investment",

"description": "A corporate takes out a bond from a bank and this bond is then syndicated amongst a group of lenders.",

"resource_url": "https://api.wisealpha.com/v1/products/?market_type=main_market"

},

{

"market_type": "high_yield",

"name": "High Yield",

"category": "investment",

"description": "High yield bonds ...",

"resource_url": "https://api.wisealpha.com/v1/products/?market_type=high_yield"

},

...

]

}

This endpoint retrieves all product types currently available through WiseAlpha.

Available Methods

- GET: Returns descriptions for all product types currently available through WiseAlpha

Product Type Description Resource

| Name | Description | Data Type |

|---|---|---|

| results[ ].market_type | Product identifier | String |

| results[ ].name | Product display name | String |

| results[ ].category | Product category | String |

| results[ ].description | A plain English description of the product | String |

| results[ ].resource_url | Product resource URL | String |

Companies

Company Update Data Types

We use the following data types in the company update endpoints:

Company Update Source

{

"id": 1136,

"name": "lse-gb",

"description": "London Stock Exchange",

"url": "https://www.londonstockexchange.com/",

"image": "https://docs.londonstockexchange.com/sites/default/files/logo.svg"

}

| Name | Description | Data Type |

|---|---|---|

| id | Company Update Source ID | Reference ID |

| name | Source name | String |

| description | short description about the source | String |

| url | URL | String |

| image | Image URL | String |

Company Update Object

{

"id": 25079,

"source": {

"id": 1136,

"name": "lse-gb",

"description": "London Stock Exchange",

"url": "https://www.londonstockexchange.com/",

"image": "https://docs.londonstockexchange.com/sites/default/files/logo.svg"

},

"title": "AA 2021Q2 financials updated",

"description": "Please find the newest AA financials here: [https://aggredium.com/company/AABOND/standardized/?data\\_view=ltm'](https://aggredium.com/company/AABOND/standardized/?data_view=ltm')\n\n ",

"published_time": "2020-09-29T11:15:44Z",

"url": "https://aggredium.com/company/AABOND/standardized/?data_view=ltm'",

"provider": "AGGREDIUM",

"type": "COMPANY_NEWS",

"image": null,

"category": "financials update",

"priority": "LOW"

}

| Name | Description | Data Type |

|---|---|---|

| id | Company Update ID | Reference ID |

| source | Update source | Company Update Source |

| title | Title of the update | String |

| description | Description of the update | Markdown String |

| published_time | Datetime when the update was published. | DateTime |

| url | URL to the original update | String |

| provider | Name of the (meta data) provider (e.g. CITY_FALCON, AGGREDIUM, WISEALPHA) |

String-Enum |

| type | Type of update (e.g. COMPANY_NEWS, PRESS) |

String-Enum |

| image | Image URL | String |

| category | Category of the update | String |

| priority | Priority level assigned to the update (e.g. LOW, MEDIUM, HIGH) |

String-Enum |

Get list of company updates

URL: GET /companies/{}/company-updates/

Example

GETrequest

api = requests.get('$API_ROOT_URL/companies/CO00000001/company-updates/limit=2&offset=10', headers=headers)

curl -s "$API_ROOT_URL/companies/CO00000001/company-updates/limit=2&offset=10" \

-H 'Authorization: Token $API_KEY' | jq .

The above command returns JSON structured like this:

{

"count": 20,

"next": "https://api.wisealpha.com/pubapi/v1/companies/CO00000019/company-updates/?limit=2&offset=12",

"previous": "https://api.wisealpha.com/pubapi/v1/companies/CO00000019/company-updates/?limit=2&offset=8",

"results": [

{

"id": 23766,

"source": {

"id": 1136,

"name": "lse-gb",

"description": "London Stock Exchange",

"url": "https://www.londonstockexchange.com/",

"image": "https://docs.londonstockexchange.com/sites/default/files/logo.svg"

},

"title": "Albert Bridge Cap Form 8.3 AA Plc",

"description": "RNS Number : 9332Y Albert Bridge Capital LLP 14 September 2020 FORM 8.3 PUBLIC OPENING POSITION DISCLOSURE/DEALING DISCLOSURE BY A PERSON WITH INTERESTS IN RELEVANT SECURITIES REPRESENTING 1% OR MORE Rule 8.3 of the Takeover Code (the \"Code\") 1. ...",

"published_time": "2020-09-14T13:04:00Z",

"url": "https://cityfalcon.com/directory/filings/GB/lse-gb/121999940-aa-plc-albert-bridge-cap-form-83-aa-plc",

"provider": "CITY_FALCON",

"type": "COMPANY_NEWS",

"image": "https://cityfalconproduction.blob.core.windows.net/autotweetmedia/domains/logos/79/small.png",

"category": "major_publication",

"priority": "LOW"

},

...

]

}

This endpoint retrieves a list of company updates linked to the current company. Results are arranged in reverse chronological order.

Optional Query Strings for GET

| Name | Description | Data Type |

|---|---|---|

| limit | limit the number of results | Integer |

| offset | offset | Integer |

| provider | Name of the (meta data) provider (e.g. CITY_FALCON, AGGREDIUM, WISEALPHA) |

String-Enum |

| type | Type of update (e.g. COMPANY_NEWS, PRESS) |

String-Enum |

| priority | Priority level assigned to the update (e.g. LOW, MEDIUM, HIGH) |

String-Enum |

Customer Profiles

These endpoints are used to fetch and update the personal information for WiseAlpha users.

If you have a super account, you can use these endpoints to create managed WiseAlpha users, and progress them through the account onboarding process.

You can also use these endpoints if you are not a super account.

In this case, setting customer_id to me in the endpoints targets the user

account associated with the API key. The list and create endpoints are only

available to super accounts.

You can find more details of the information we gather and how it is used in the onboarding section of this document.

Customer Profile Data Types

We use the following data types in the profile endpoints:

Profile object

We return this object when details of a WiseAlpha user are requested. It is also used when

creating and updating user information, and subsets of this object are used in the PATCH

method of the /customers/{customer_id}/ endpoint.

{

"customer_id":"10000001",

"email":"user1@example.com",

"title":"mr",

"first_name":"FirstName",

"last_name":"LastName",

"contact_number":null,

"nationality":"GB",

"date_of_birth":null,

"date_joined":"2017-11-23T11:17:05.488037Z",

"address":null,

"previous_addresses":[],

"bank_details":{

"GBP":{

"provided":false,

"last_error":""

},

"EUR":{

"provided":false,

"last_error":""

}

},

"investor_type":null,

"user_agreement": {

"client-account-migration": {

"reference": "client-account-migration",

"agreement": "$API_ROOT_URL/customers/me/user-agreements/client-account-migration/",

"choices": [

{

"reference": "move_funds",

"text": "Move Funds To Client Account"

},

{

"reference": "withdraw_funds",

"text": "Withdraw Funds"

}

],

"decision": ""

}

},

"tos_acceptance":{},

"ifisa_agreement_acceptance": null,

"access_restrictions": {

"high_yield": {

"investor_type": true,

"questionnaire": false,

"access_approved": false,

"message": "message"

},

"perpetuals": {

"investor_type": false,

"questionnaire": false,

"access_approved": false,

"message": "message"

},

"special_situations": {

"investor_type": false,

"questionnaire": false,

"access_approved": false,

"message": "message"

}

},

"validation":{

"status":"onboarding",

"can_withdraw":false,

"can_invest_high_yield":false,

"can_invest_perpetuals":false,

"can_invest_special_situations":false,

"next_actions":[

"provide-missing-fields",

"select-investor-type"

],

"can_invest":false,

"aml_check":{

"status":"No Check Performed",

"passed":false

},

"fields_needed":[

"nationality",

"date_of_birth",

"contact_number",

"address",

"bank_details",

"tos_acceptance",

"tax_residencies",

"user_agreement:client-account-migration"

],

"documents":{

"proof_of_address":"not-yet-needed",

"photo_id":"not-yet-needed"

},

"document_info": {},

"questionnaire":{

"high-yield": "not-attempted",

"perpetual": "not-attempted",

"signup": "not-attempted",

"smart-interest": "not-attempted",

"special-situation": "not-attempted"

}

}

}

| Name | Description | Data Type |

|---|---|---|

| customer_id | The ID of the account. | Customer ID |

| Email of the user associated with the account. | String | |

| title | Title of the user associated with the account. | String |

| first_name | First name of the user associated with the account. | String |

| last_name | Last name of the user associated with the account. | String |

| contact_number | User's telephone number - we occasionally need to contact the user for compliance purposes | String |

| nationality | Country code for user's nationality | Country Code |

| date_of_birth | Date of birth of the user | Date |

| date_joined | The date the user joined wisealpha | DateTime |

| address | Current address of the user. | Address object |

| previous_addresses | Previous addresses of the user. You should provide addresses to cover the last 3 years. | List of Address objects |

| bank_details | The user's bank-account details. Payouts are transferred to this account. | Bank account object |

| tax_residencies | The user's current tax residencies. | List of Tax residency objects |

| investor_type | The type of this investor | Investor type object (Read Only) |

| user_agreements | All the legal agreements relating to the user | User agreements object |

| tos_acceptance | Details of when the user accepted the WiseAlpha Terms Of Service | TOS object |

| ifisa_agreement_acceptance | Details of when the user accepted the WiseAlpha IF ISA Agreement | TOS object |

| access_restrictions | Details of any access restrictions that apply to this account | Access restrictions object (Read Only) |

| validation | Details of the user's progress through the Onboarding process | Validation object (Read Only) |

The email address field must be unique across the WiseAlpha platform. If you try to create an account with a pre-existing email address, or update the email address to match another account, then the API will return an error.

customer_id, date_joined, investor_type, access_restrictions, and validation are read-only fields, and cannot be updated by users.

Investor type is set/updated using the /customers/{customer_id}/change_investor_type/ endpoint.

bank_details is a special object - you can set its value, but when read it just returns

whether the value has been set or not. See the bank account object for details.

Address object

This is the data type used for user addresses in the profile object.

{

"flat_or_apartment_number":null,

"house_name":null,

"house_number":"1",

"address1":"John Street",

"address2":null,

"address3":"London",

"address4":null,

"post_code":"N1 1XX",

"country": "gb",

"from_date":"2016-01-01",

"to_date": null

}

| Name | Description | Data Type |

|---|---|---|

| flat_or_apartment_number | Flat number, if residence is a flat | See note below |

| house_name | Name of the house, if it has one | See note below |

| house_number | Number of the house, if it has one | See note below |

| address1 | e.g., Street name | String |

| address2 | Optional String | |

| address3 | Town/City name | String |

| address4 | Optional String | |

| post_code | Post Code/Zip Code | String |

| country | Country | Country Code |

| from_date | The date the user moved to this address | Date |

| to_date | The date the user moved to this address | Optional Date |

Note: You must specify at least one of flat_or_apartment_number, house_number, house_name.

For the address field in the profile object (i.e., the user's current address),

the to_date is assumed to be unset, and is ignored.

Bank account object

This object contains the user's bank-account details.

{

"account_name": "FirstName LastName",

"sort_code":"00-00-00",

"account_number":"88668866",

}

| Name | Description | Data Type |

|---|---|---|

| account_name | The name of the account owner | String |

| sort_code | The sort code (or BIC) of the bank holding the account | String |

| account_number | The account number (or IBAN) | String |

Note that you should specify either sort code and account number or BIC and IBAN. Mixing the two types of bank identifiers is not supported.

When read, we return a data blob with additional information.

{

"provided":true,

"status":"verified",

"last_error":""

"details": {

"account_name": "FirstName LastName",

"sort_code":"00-00-00",

"account_number":"88668866",

}

}

| Name | Description | Data Type |

|---|---|---|

| provided | Whether bank account details have been provided | Boolean |

| status | Whether the account details have been approved for use. One of unverified, verified, rejected, 'request-new' |

String |

| last_error | The reason the bank details were rejected, or new details requested. | String |

| details | The bank details | Object |

Tax residency object

This object contains details of a tax residency.

{

"country": "gb",

"tax_indentification_number": "QQ123456C"

}

| Name | Description | Data Type |

|---|---|---|

| country | The country of the tax residency | Country Code |

| tax_identification_number | The tax identification number | String |

Change investor type object

Not all fields are mandatory for all investor type - see below for more information.

Mandatory fields for all investor types

| Name | Description | Data Type |

|---|---|---|

| investor_type_id | The user's investor type id. | Integer |

| annual_income | The user's declared annual income. | Decimal |

| annual_income_currency | The currency of the user's declared annual income. | Currency |

| net_investible_assets | The user's declared net investible assets. | Decimal |

| net_investible_assets_currency | The currency of the user's declared net investible assets | Currency |

Certified High Net Worth Investor type validation

There are no additional fields required for the Certified High Net Worth Investor type, but either the

annual_income submitted must be at least GBP100,000 or the net_investible_assets submitted must be

at least GBP250,000.

Professional Investor type validation

The additional below fields are required for the Professional Investor type.

| Name | Description | Data Type |

|---|---|---|

| professional_investment_experience | A description of the customer's professional investment experience. | String |

Advised Investor type validation

The additional below fields are required for the Advised Investor type.

| Name | Description | Data Type |

|---|---|---|

| advisor_name | The customer's advisors name. | String |

| advisor_fca_reference_number | The customer's advisors FCA reference number. | String |

| advisor_is_fca_authorised | A confirmation that the customers advisor is FCA authorised - this must be true. | Boolean |

Sophisticated Investor type validation

The additional below fields are required for the Self-Certified Sophisticated Investor type and at least one of them must

be set to true. They all refer to activities that must have taken part in the prior 6 months.

| Name | Description | Data Type |

|---|---|---|

| angel | The customer has been a member of a business angel network. | Boolean |

| unlisted | The customer has invested in a WiseAlpha product, an unlisted company, P2P, Crowdfunding or a Venture Capital firm. | Boolean |

| professional | The customer has worked professionally in the private equity sector, or the provision of finance for small and medium enterprises. | Boolean |

| director | The customer has been a directory of a company with £1m+ in turnover. | Boolean |

Investor type summary object

This object is read-only. To set the customer's investor type, you need to use the set-investor-type

{

"investor_type_id": 1,

"investor_type_identifier": "Certified High Net Worth Investor",

"investor_type": "High Net Worth Investor",

"is_retail_restricted": false,

"annual_income": "105000",

"annual_income_currency": "GBP",

"net_investible_assets": "350000",

"net_investible_assets_currency": "GBP",

"professional_investment_experience": null,

"occupation": "CEO",

"date_selected": "2017-11-23T14:08:19.107968Z",

}

| Name | Description | Data Type |

|---|---|---|

| investor_type_id | The customer's investor type id | Integer |

| investor_type_identifier | The customer's investor type identifier | String |

| investor_type | The text label describing this user's investor type | String |

| is_retail_restricted | Set true if the user is a retail investor. Retail investors cannot invest in some of the more sophisticated investments | Boolean |

| annual_income | The customer's declared annual income. | Decimal |

| annual_income_currency | The currency of the customer's declared annual income. | Currency |

| net_investible_assets | The customer's declared net investible assets. | Decimal |

| net_investible_assets_currency | The currency of the user's declared net investible assets | Currency |

| professional_investment_experience | The customer's professional investment experience | String |

| advisor_name | The customer's advisors name. | String |

| advisor_fca_reference_number | The customer's advisors FCA reference number. | String |

| advisor_is_fca_authorised | A confirmation that the customers advisor is FCA authorised - this must be true. | Boolean |

| angel | The customer has been a member of a business angel network. | Boolean |

| unlisted | The customer has invested in a WiseAlpha product, an unlisted company, P2P, Crowdfunding or a Venture Capital firm. | Boolean |

| professional | The customer has worked professionally in the private equity sector, or the provision of finance for small and medium enterprises. | Boolean |

| director | The customer has been a directory of a company with £1m+ in turnover. | Boolean |

| date_selected | The date the customer selected their investor type | DateTime |

User agreements object

This object should be written when the customer has accepted the WiseAlpha Terms Of Service. It should consist of a dictionary with the following fields:

{

"client-account-migration": {

"reference": "client-account-migration",

"agreement": "$API_ROOT_URL/customers/me/user-agreements/client-account-migration/",

"choices": [

{

"reference": "move_funds",

"text": "Move Funds To Client Account"

},

{

"reference": "withdraw_funds",

"text": "Withdraw Funds"

}

],

"decision": ""

}

}

| Name | Description | Data Type |

|---|---|---|

| client-account-migration | The client account migration agreement | User agreement object |

User agreement object

This is a general form of all user agreements:

{

"reference": "agreement-reference-identifier",

"agreement": "$API_ROOT_URL/customers/me/user-agreements/agreement-markdown-text/",

"choices": [

{

"reference": "choice_1",

"text": "This is choice #1"

},

{

"reference": "choice_2",

"text": "This is choice #2"

}

],

"decision": ""

}

| Name | Description | Data Type |

|---|---|---|

| reference | An identifier used to reference the agreement | String |

| agreement | The URL of the agreement text | String |

| choices | The choices available to the user | User agreement choice object |

| decision | The record of the user's decision | String |

User agreement choice object

This is the general form for choices in user agreements:

{

"reference": "choice_1",

"text": "This is choice #1"

}

| Name | Description | Data Type |

|---|---|---|

| reference | The identifier of the choice. This value must be submitted as the "decision". | String |

| text | Text to display to the user | User agreement object |

TOS object

This object should be written when the customer has accepted the WiseAlpha Terms Of Service. It should consist of a dictionary with the following fields:

{

"date":"2017-11-23T11:17:05.488037Z",

"ip_address": "1.2.3.4"

}

| Name | Description | Data Type |

|---|---|---|

| date | Date the customer accepted the Terms Of Service | DateTime |

| ip_address | IP address of the customer's computer when he accepted the Terms Of Service | String |

Access restrictions object

This object details the nature of each access restriction that applies to this user.

For a user to gain access to an investment with a particular restriction, he must satisfy two criteria:

They must be of the correct investor type. In particular

retail_restrictedinvestors cannot access riskier investments.They must answer an appropriate investment questionnaire to show that they understand the nature of the risks involved.

This object outlines the user's progress in achieving these criteria.

"access_restrictions": {

"high_yield": {

"investor_type": true,

"questionnaire": false,

"access_approved": false,

"message": "message"

},

"perpetuals": {

"investor_type": false,

"questionnaire": false,

"access_approved": false,

"message": "message"

},

"special_situations": {

"investor_type": false,

"questionnaire": false,

"access_approved": false,

"message": "message"

}

},

Each access restriction has the following fields:

| Name | Description | Data Type |

|---|---|---|

| investor_type | Is the user's investor type allowed to access these investments? | Boolean |

| questionnaire | Has the user completed the necessary questionnaire for these investments? | Boolean |

| message | A brief message describing what the user needs to do to access these investments | String |

| access_approved | Has the user got access to these investments. | Boolean |

Note that access_approved may be false even if the investor_type and questionnaire are true;

in this case the user access permission is awaiting approval from a member of the WiseAlpha team.

Validation object

This records the customer's progress through the onboarding process.

{

"status":"onboarding",

"can_invest": false,

"can_invest_high_yield": false,

"can_invest_perpetuals": false,

"can_invest_special_situations": false,

"can_withdraw": false,

"next_actions":[

"provide-missing-fields",

"select-investor-type"

],

"fields_needed":[

"date_of_birth",

"contact_number",

"address",

"bank_details",

"tos_acceptance"

],

"aml_check":{

"status":"No Check Performed",

"passed":false

},

"documents":{

"proof_of_address":"not-yet-needed",

"photo_id":"not-yet-needed"

},

"document_info":{},

"questionnaire":{

"high-yield": "not-attempted",

"perpetual": "not-attempted",

"signup": "not-attempted",

"smart-interest": "not-attempted",

"special-situation": "not-attempted"

}

}

| Name | Description | Data Type |

|---|---|---|

| status | The status of the onboarding process | String |

| can_invest | Can this user deposit money and buy fractional bonds? | Boolean |

| can_invest_high_yield | Can this user invest in the high yield bonds market? | Boolean |

| can_invest_perpetuals | Can this user invest in the perpetual market? | Boolean |

| can_invest_special_situations | Can this user invest in the special situation market? | Boolean |

| can_withdraw | Can this user withdraw funds | Boolean |

| next_actions | What actions should the user do next | List of Strings |

| fields_needed | If next_actions contains "provide-missing-fields" this list identifies which fields should be provided | List of Strings |

| aml_check | The AML check object | |

| aml_check.status | The status of the AML check. See [onboarding] for details | String |

| aml_check.passed | Whether the AML check has been passed | Boolean |

| documents | List of required documents and their current upload status | Map of key-value pairs. |

| document_info | Extra information (such as reason document was rejected) to help with uploading the correct document | Map of key-value pairs. |

The keys for the documents and document_info maps will be one of the known

document types: photo_id, proof_of_address, bank_statement:<currency>. For documents

other than photo_id and proof_of_address, we will not add an entry in documents

unless that document is required.

The values for the documents map will be one of: not-yet-needed, required,

provided, approved, rejected.

If a document is in the rejected state, then document_info.rejection_reason will

contain a description of the rejection reason.

More details of the meaning of each of these fields can be found in the onboarding section of this document.

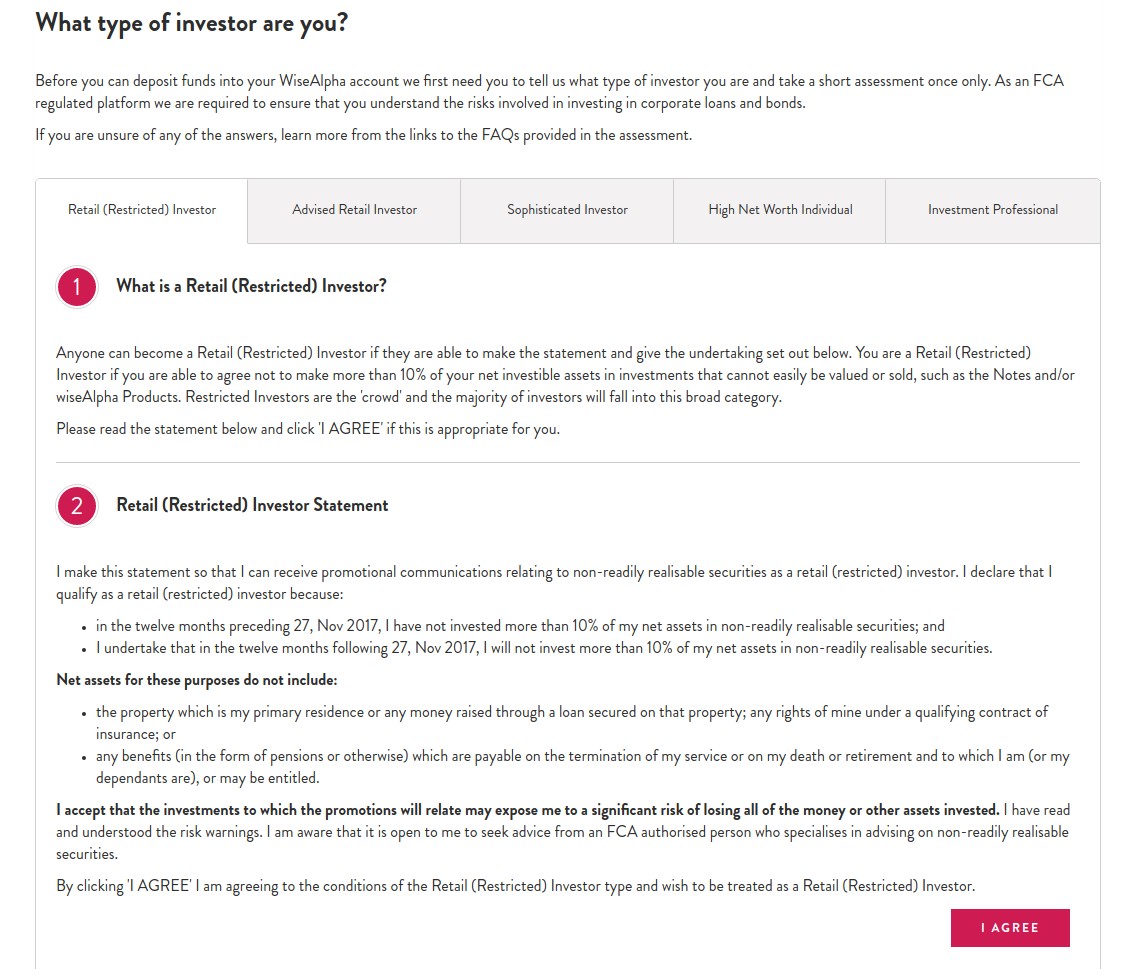

Investor type object

We return a list of these objects from the investor_types endpoint.

This information should be displayed to the user when he is selecting his investor type.

The title field should be used in the toggle used to select the investor type.

The intro_title and intro_content fields give a brief overview of what each

investor type entails.

The main_title and main_content outline the terms the user is agreeing to by

selecting that investor type.

Once a user has selected an investor type, the id and title fields are returned

in the user's investor type summary object. The indentifier field can be used to map the investor

type to it's required fields on submission of a change investor type request.

More details on the investor-type-selection process can be found in the onboarding section of this document.

{

"id":1,

"identifier": "Certified High Net Worth Investor",

"title":"High Net Worth Investor",

"intro_title":" What is a Certified High Net Worth Investor?",

"intro_content":"<p>Description of this investor type.</p>\r\n",

"main_title":"Certified High Net Worth Investor Statement",

"main_content":"<p>What the investor is agreeing to.....</p>"

}

| Name | Description | Data Type |

|---|---|---|

| id | ID of this investor type | Integer |

| identifier | A string identifying this investor type, one of Standard Investor, Self-Certified Sophisticated Investor, Professional Investor, Certified High Net Worth Investor or Advised Investor |

String-Enum |

| title | Title/identifying string for this investor type | String |

| intro_title | Page title to use when presenting this investor type | String |

| intro_content | Description of this investor type | HTML String |

| main_title | Header for the investor agreement for this investor type | String |

| main_content | Investor agreement | HTML String |

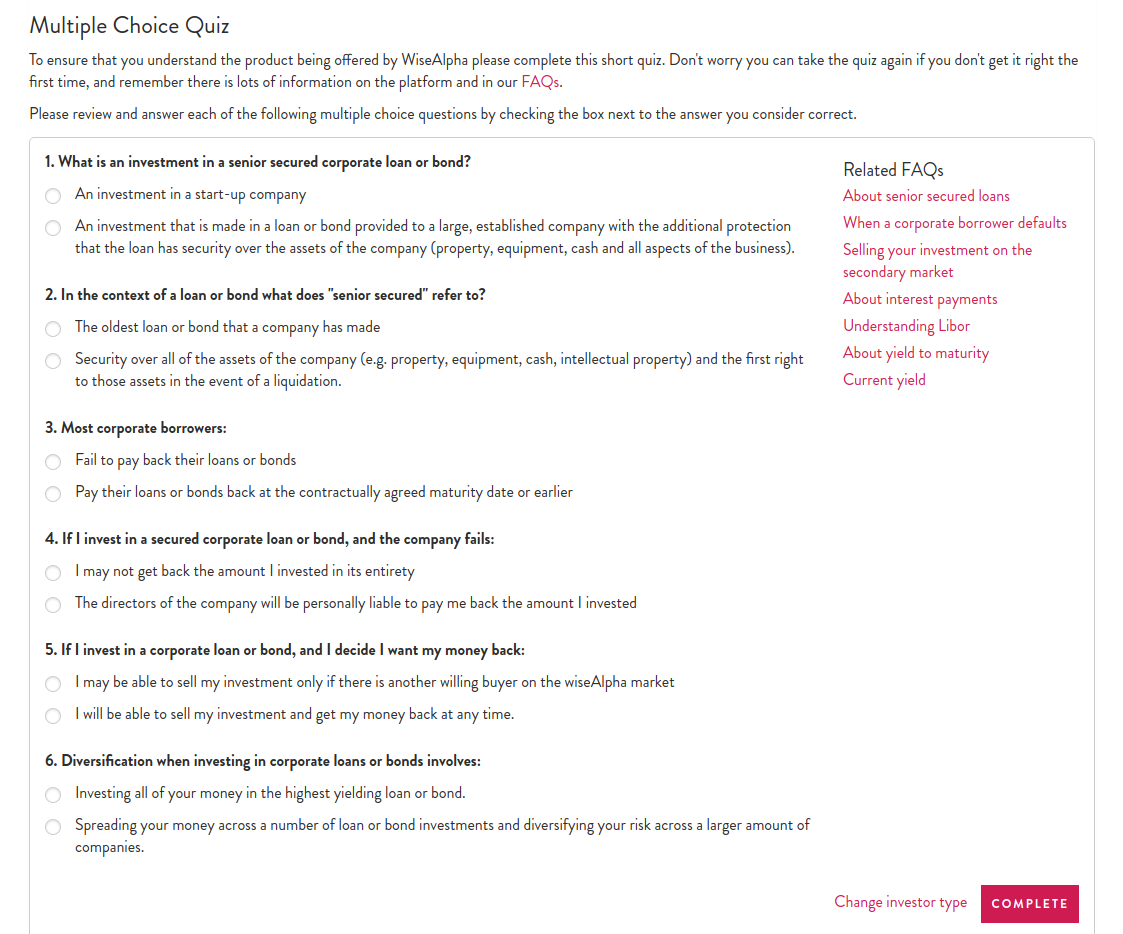

Questionnaire object

We return this object via the questionnaire endpoint.

Each question in the questions array represents a single multiple-choice question.

{

"type":"signup",

"help": "help text",

"questions":[

{

"id":1,

"question":"Question 1?",

"answers":[

{

"id":3,

"answer_text":"Answer 1."

},

{

"id":1,

"answer_text":"Answer 2."

}

],

"mimetype": "text/plain",

"question_type": "radio"

},

...

],

"faqs": [

{

"title": "What are Senior Secured bonds ?",

"link": "https://support.wisealpha.com/glossary/senior-secured"

},

{

"title": "What happens when a corporate borrower defaults ?",

"link": "https://support.wisealpha.com/about-wisealpha/what-happens-if-a-borrower-defaults"

},

{

"title": "How does our secondary market operate ?",

"link": "https://support.wisealpha.com/glossary/secondary-market"

},

{

"title": "When will I receive Interest Payments ?",

"link": "https://support.wisealpha.com/payments-and-fees/when-will-i-receive-interest-payments"

},

{

"title": "What is Yield To Maturity ?",

"link": "https://support.wisealpha.com/glossary/yield-to-maturity"

},

{

"title": "What is Current Yield ?",

"link": "https://support.wisealpha.com/glossary/current-yield"

}

],

"user_status": {

"blocked_message": null,

"num_failed_attempts": 0,

"max_num_failed_attempts": 3,

"num_attempts_remaining": 3,

"passed": false

},

"hash": "680b7d32e5f5b39528b46dd0e4051c41"

}

| Name | Description | Data Type |

|---|---|---|

| type | Questionnaire type | String, either signup, high-yield, special-situation or perpetual |

| help | Help text to display if the user fails to pass the questionnaire. | String |

| questions | Questions to ask | List of question objects |

| faqs | Frequently asked questions relating to this questionnaire | List of FAQ objects |

| user_status | If this questionnaire is being retrieved in the context of a user then returned will be the user's current questionnaire status, null otherwise. | A questionnaire user status object. |

Question object

| Name | Description | Data Type |

|---|---|---|

| id | ID of this question | Integer |

| question | The question text | String |

| mimetype | The mimetype of the question text. | Can be one of text/plain, text/markdown |

| question_type | The type of question | Can be one of radio, free_text |

| answers | Answers for this question | List of answer objects |

Answer object

| Name | Description | Data Type |

|---|---|---|

| id | ID of this answer | Integer |

| answer_text | Text for this answer | String |

FAQ object

| Name | Description | Data Type |

|---|---|---|

| title | FAQ title | String |

| link | FAQ link | String |

Questionnaire user status object

| Name | Description | Data Type |

|---|---|---|

| blocked_message | If set, the user has been blocked on the questionnaire. This can be due to an answer having been submitted that needs a compliance action before continuing. | String |

| num_failed_attempts | The number of times the user has attempted and failed this questionnaire. | Integer |

| max_num_failed_attempts | The maximum number of times the user can fail this questionnaire before being blocked, can be null. | Integer |

| num_attempts_remaining | The number of attempts the user had remaining to pass this questionnaire, can be null. | Integer |

| passed | Have they passed this questionnaire? | Boolean |

List customers

URL: POST /customers/

Example

GETrequest

api = requests.get('$API_ROOT_URL/customers/', headers=headers)

curl -s "$API_ROOT_URL/customers/" \

-H 'Authorization: Token $API_KEY' | jq .

The above command returns pagination object containing a list of managed user accounts associated with the current API key. The resulting JSON is structured like this:

{

"count": 6,

"next": null,

"previous": null,

"results": [

{

"customer_id":"10000001",

"email":"user1@example.com",

"title":"mr",

"first_name":"FirstName",

"last_name":"LastName",

"contact_number":"07777777777",

"nationality":"GB",

"date_of_birth":"2000-01-01",

"date_joined":"2017-11-23T11:17:05.488037Z",

"address":{ address... },

"previous_addresses":[],

"bank_details":{

"provided":true,

"last_error":""

},

"investor_type":null,

"user_agreement": {},

"tos_acceptance":{ },

"ifisa_agreement_acceptance": null,

"validation":{ validation... }

}

...

]

}

Example

POSTrequest

data = {

"email": "user@example.com",

"first_name": "FirstName",

"last_name": "LastName"

}

api = requests.post('$API_ROOT_URL/customers/', data=data, headers=headers)

curl -s -X POST $API_ROOT_URL/customers/ \

-H 'Authorization: Token $API_KEY' \

-H 'Content-Type: application/json' \

-d '{"email": "user1@example.com","first_name": "FirstName", "last_name": "LastName"}' | jq .

The above command creates a managed user account and associates it with the current API key. On success, it returns the profile object for the resulting user.

{

"customer_id":"10000001",

"email":"user1@example.com",

"title":"mr",

"first_name":"FirstName",

"last_name":"LastName",

"contact_number":null,

"nationality":"GB",

"date_of_birth":null,

"date_joined":"2017-11-23T11:17:05.488037Z",

"address":null,

"previous_addresses":[],

"bank_details":{

"provided":false,

"last_error":""

},

"investor_type":null,

"user_agreement": {},

"tos_acceptance":{},

"ifisa_agreement_acceptance": null,

"validation":{

"status":"onboarding",

"can_withdraw":false,

"can_invest_high_yield":false,

"can_invest_perpetuals":false,

"can_invest_special_situations":false,

"next_actions":[

"provide-missing-fields",

"select-investor-type"

],

"can_invest":false,

"aml_check":{

"status":"No Check Performed",

"passed":false

},

"fields_needed":[

"nationality",

"date_of_birth",

"contact_number",

"address",

"bank_details",

"tos_acceptance"

],

"documents":{

"proof_of_address":"not-yet-needed",

"photo_id":"not-yet-needed"

},

"document_info":{},

"questionnaire":{

"high-yield": "not-attempted",

"perpetual": "not-attempted",

"signup": "not-attempted",

"smart-interest": "not-attempted",

"special-situation": "not-attempted"

}

}

}

This endpoint is used to list and create accounts that have been associated with the API key in use (i.e., "super accounts")

This endpoint is only available to accounts that have been configured as a Super Account. If ordinary users try to use this method, it will return 403 - Permission Denied.

Available Methods:

- GET: Returns all accounts associated with the current API key

- POST: Creates a new account and associates it with the current API key

Suported Ordering Fields

| Field Name |

|---|

date_joined |

first_name |

last_name |

email |

Suported Filtering

| Field Name | Support Lookups |

|---|---|

email |

All text lookups supported |

first_name |

All text lookups supported |

last_name |

All text lookups supported |

search |